SACRAMENTO, Calif. — Here at ABC10, we stand for you and our Dollars and Sense team has answered more than 20,000 of your financial questions since the start of the pandemic.

Recently, viewers have been asking about the second round of stimulus checks. Here are the top questions for the week:

How do I sign up for direct deposit for the second round of stimulus checks?

If you qualify for a second stimulus check and have filed your 2019 tax return with the correct direct deposit information, you don't have to do anything else.

If you aren't required to file a tax return, you'll have to wait for the IRS to open up the non-filers payment tool.

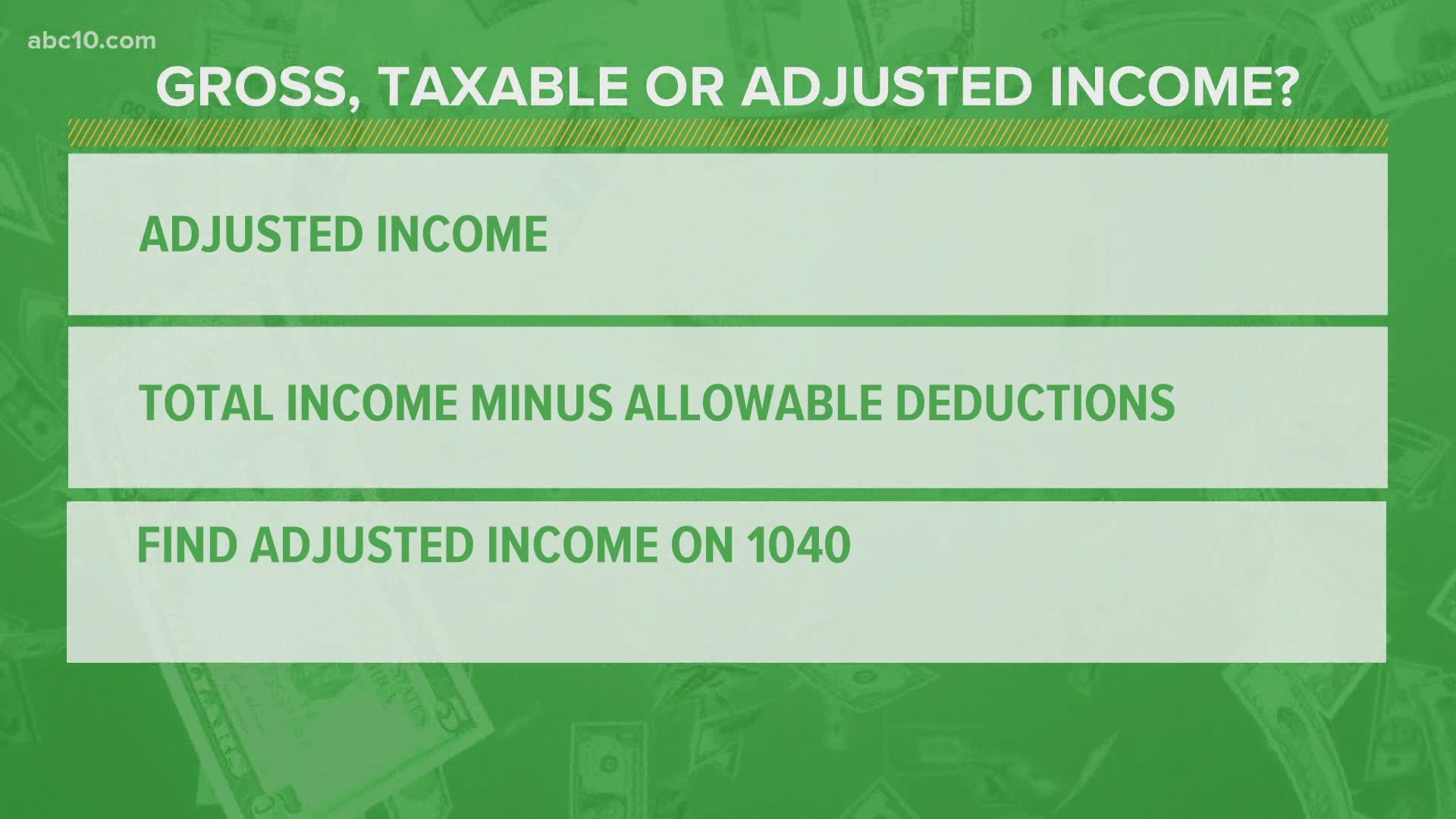

Is the $75,000-$150,000 income phase based on gross income, adjusted gross income or federal taxable income?

It's based on your adjusted gross income. Adjustable gross income is your gross income minus adjustments to your income. You can find your AGI on your 1040 tax form.