SACRAMENTO, Calif. — Monique Campbell-Spivey, who lives in Sacramento, earned a Bachelor's degree in child development from California State University, Fresno in 2011.

She's a first-generation college attendee and graduate. Campbell-Spivey says she's been working hard to pay off student loan debt, totaling $20,000, over the years.

"It's been a struggle," Campbell-Spivey said. "I've been doing deferment, forbearance and repayment plans. I've had to change jobs. Plus, I'm a single mother. I ran into late fees because I was unable to meet the commitment to the student loans."

More than 45 million people hold federal student loans in the U.S., making the cumulative federal student loan debt $1.6 trillion, according to a recent report from the Congressional Research Service (CRS).

President Biden announced a plan on Wednesday to address America's student loan debt crisis. If you earn less than $125,000 annually, he says you're eligible to get up to $10,000 in debt cancellation. If you received a Pell Grant, you can get up to $20,000 forgiven.

The U.S. Department of Education is expected to provide more details on how people can apply and claim student loan debt relief in the weeks ahead. The Department says nearly 8 million borrowers may be eligible to receive relief automatically "because relevant income data is already available to the Department."

Campbell-Spivey agrees with the Biden Administration plan. She says she will apply for student loan debt relief as soon as an application becomes available. She's also relying on debt forgiveness to pursue a Master's degree in the future.

"It will help me tremendously," Campbell-Spivey said. "My current undergraduate debt has stalled me in getting a future education. Plus, I have seven years until my daughter will go off to college. So, I want to be able to prepare for that too."

When it comes to student debt, there's a racial and gender divide. Women hold nearly two-thirds of the outstanding student debt in the U.S. -- close to $929 billion, according to a report by the American Association of University Women (AAUW), a non-profit organization on a mission "to advance gender equity for women and girls through research, education, and advocacy."

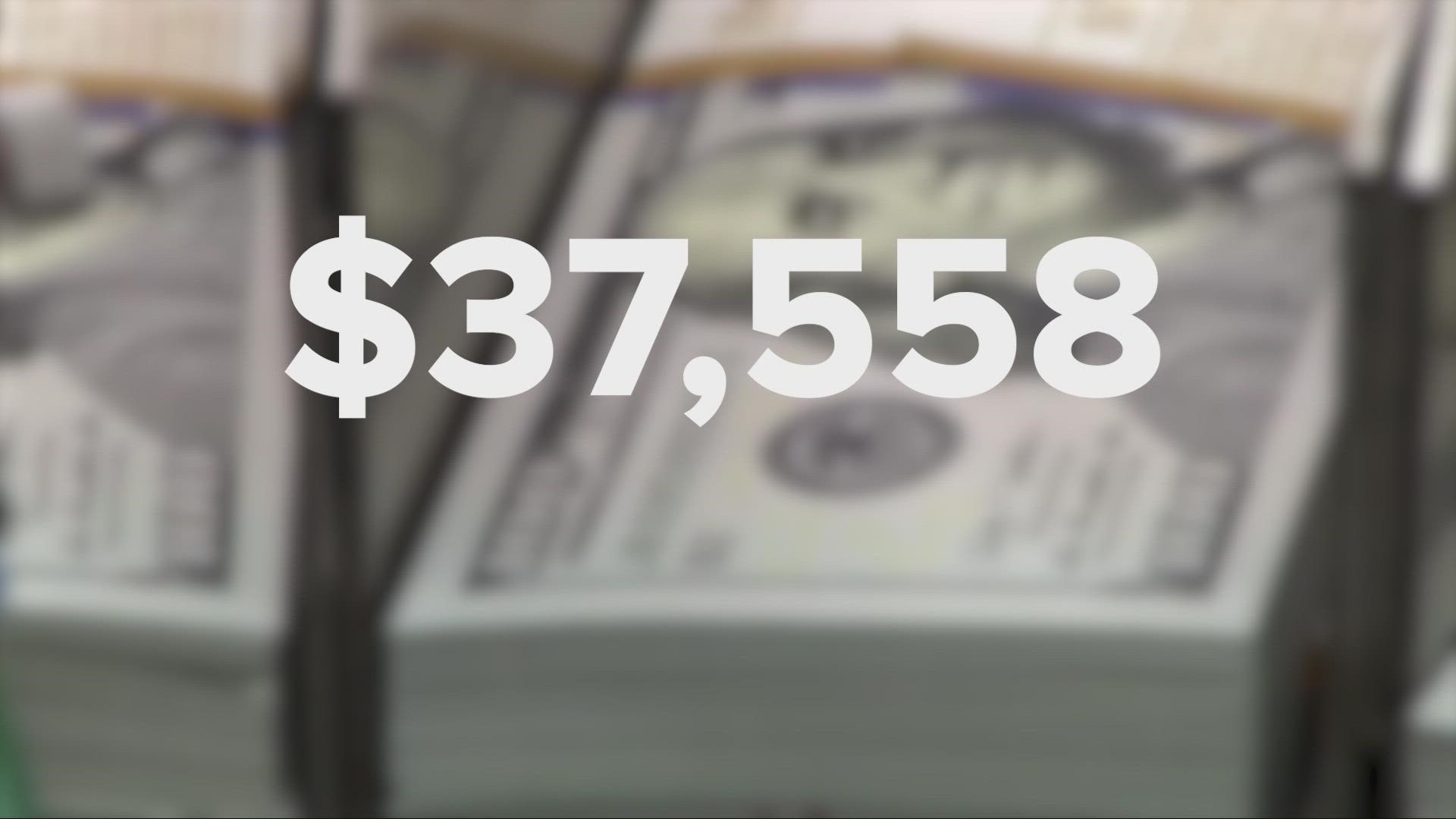

The report shows women graduates owing almost $22,000 in student debt, compared $18,880 owed by men. Black women graduate with an average of $37,558 in student debt. More than 70% of Black students go into debt to pay for higher education, compared to 56% of white students.

"Women and their families need more," said Gloria L. Blackwell, AAUW Chief Executive Officer. "Student loan debt remains an enormous obstacle to both gender and racial equity. To make a meaningful difference for American women, the Administration must provide permanent solutions to canceling student debt and expanding loan-repayment programs."

Tera Reynolds, who lives in Sacramento, is working to pay off $171,000 in student debt. She earned an undergraduate degree in criminal justice, along with a Master's degree in social work and a Doctorate in educational leadership and policy administration.

Reynolds says the debt is unbearable. She's calling on the White House to do more to help women, especially Black women, struggling to make ends meet due to student loans and payments.

"It's not even scratching the surface of my student loan debt," Reynolds said. "It's a nice beginning step, but that's only if you qualify. They should be able to do more for our own folks, in cancelling student loan debt."

Since the start of the COVID-19 pandemic in 2020, borrowers have not had to make payments on student loans. Under the White House new plan, the pause on federal student loan repayment will be extended one final time through December 31, 2022. Borrowers should expect to resume payment in January 2023.