KUSA — The largest healthcare system in the Denver area, as a matter of practice, says it won’t place liens on property or garnish wages to try to recoup unpaid bills, but a 9Wants to Know investigation found multiple surgeons with privileges inside its facilities used the same aggressive bill collection efforts the medical giant rejects.

The apparent inconsistency has, on occasion, left HealthONE patients vulnerable to lawsuits demanding hundreds, if not thousands, of dollars as well as property liens and wage garnishments. HealthONE is owned by Hospital Corporation of America, one of the nation’s largest for-profit healthcare providers.

The problem lies in the way many hospitals function these days. The surgeons who operate, emergency medicine doctors who evaluate, and many other physicians who practice medicine are often working as what amounts to independent contractors.

In other words, they work in hospitals but not for hospitals.

Those doctors are not obligated to accept the same insurance plans as the hospitals in which they work, an issue that can lead to multiple financial problems for their patients.

Let’s look at the case of a patient named Emmett Malone who deliberately chose a hospital due to its contract with his insurance company.

PREVIOUS STORY | How you can visit the hospital, then get a lien on your home

Malone went to Swedish Medical Center in 2016 with a pain in his gut. In an appeal he would later write to his insurance company (a letter Malone provided to 9Wants to Know), Malone explained what happened:

“I was not given a choice of doctor and had emergency surgery to get my appendix removed,” he wrote. “The doctor that performed my surgery was Glenda Quan, whom I was not informed until later, was not in-network.”

In Malone’s case, the hospital was in-network with his insurance, but the doctor was not.

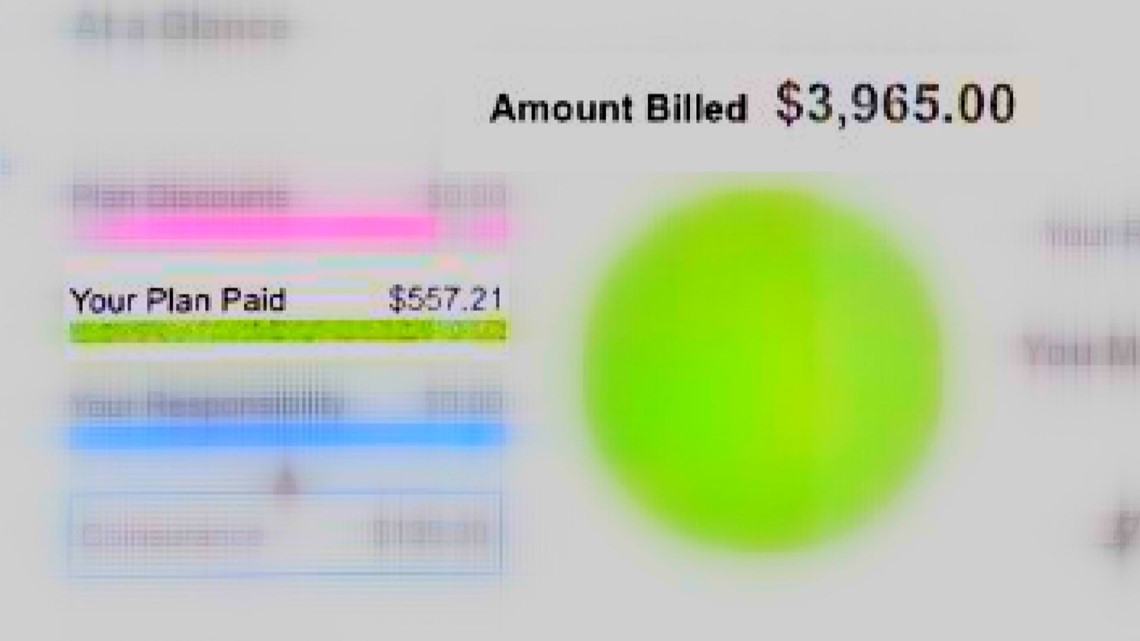

Months after the surgery, UnitedHealthcare Malone’s insurance paid the surgeon $557.21 for her role in the surgery and informed Malone he’d be responsible for an additional $139.30, according to an Explanation of Benefits provided to 9Wants to Know.

The payment wasn’t enough for the surgeon who then went ahead and billed Malone for thousands more.

Malone appealed to his insurance company, but it didn’t work. UnitedHealthcare wasn’t willing to pay the surgeon any more money.

In 2017, a collections company known as Credit Systems Inc. sued Malone for the balance of the bill left unpaid by his insurance – an amount that, after interest, totaled more than $3,500.

On Aug. 21, 2017, a judge ruled against Malone. Credit Systems then placed a lien on his home two weeks later.

Malone wanted to know why the hospital he went to would allow this.

Stephanie Sullivan, a spokesperson for HealthONE, told 9Wants to Know in an email, “We’ll work with any patient on payment of his or her bill and it is not HealthONE’s practice to place liens on property or garnish wages for payment.”

Yet the doctor who removed Malone’s appendix – a doctor who did so while working in a HealthOne hospital, a hospital that in 2016 was ranked as one of the country’s most profitable – works with a collections company that did not adhere to that policy.

Dr. Quan did not respond to multiple calls to her office. 9Wants to Know found she’s hardly alone in this.

9Wants to Know found five of the seven doctors who staff Swedish’s “Emergency General Surgery and Trauma” office, located on the hospital’s campus, use or have used a billing company out of Colorado Springs known as Aspen Medical Management.

PREVIOUS STORY | Why the law isn't protecting patients from surprise medical bills

9Wants to Know connected the doctors with Aspen Medical Management after reviewing the doctors’ publicly-available National Provider Identifier numbers. Their NPI numbers all indicate the same billing address as Aspen Medical Management.

Aspen Medical Management’s cases, according to multiple lawsuits reviewed by 9Wants to Know, are routinely forwarded to Credit Systems Inc. for bill collection.

County clerk and recorder reports reviewed by 9Wants to Know indicate Credit Systems Inc. has placed more than 170 liens on homes in the Denver area since the start of last year. That number includes the home of Emmett Malone.

HealthONE refused a request for a formal interview to answer additional questions 9Wants to Know had about out-of-network billing practices of doctors who work within their hospitals.

A representative with the Colorado Hospital Association did agree to an interview revolving around surprise billing in general. CHA is “the leading voice of the Colorado hospital and health system community,” according to its website.

“Unequivocally, hospitals want to find a solution to this problem,” said Katherine Mulready, the chief strategy officer for CHA.

Mulready said CHA would like hospitals to have access to more information regarding what insurance plans physicians do and do not accept, but the data is difficult to track due to sheer volume of doctors who work in their facilities and number of insurance plans offered in the state.

“There are just too many variables, and hospitals don’t have any more insight into it any more than the patient does,” Mulready said.

“So, we don’t know actually how big the problem may be,” she added.

When asked if CHA’s member hospitals should at least try to do more to figure it out, she replied, “It’s not information we have access to.”