The first four propositions on California's statewide ballot this November would all take out new bonds.

That sounds a bit dry, so let's try this: They want to borrow billions of dollars now to spend on stuff. And then spend billions more of your tax dollars to pay it back with interest for decades to come.

There's nothing inherently wrong with the concept of paying for things this way.

The closest thing you're likely to experience to one of these bonds in your real life is a home mortgage. The reason you take out a home loan is that it lets you have a house today rather than saving your pennies for decades.

But it costs. If you look at the disclosure documents on your home loan, you might notice that you end up paying about double for the house with interest over the long run. The same thing happens when the state takes out bonds.

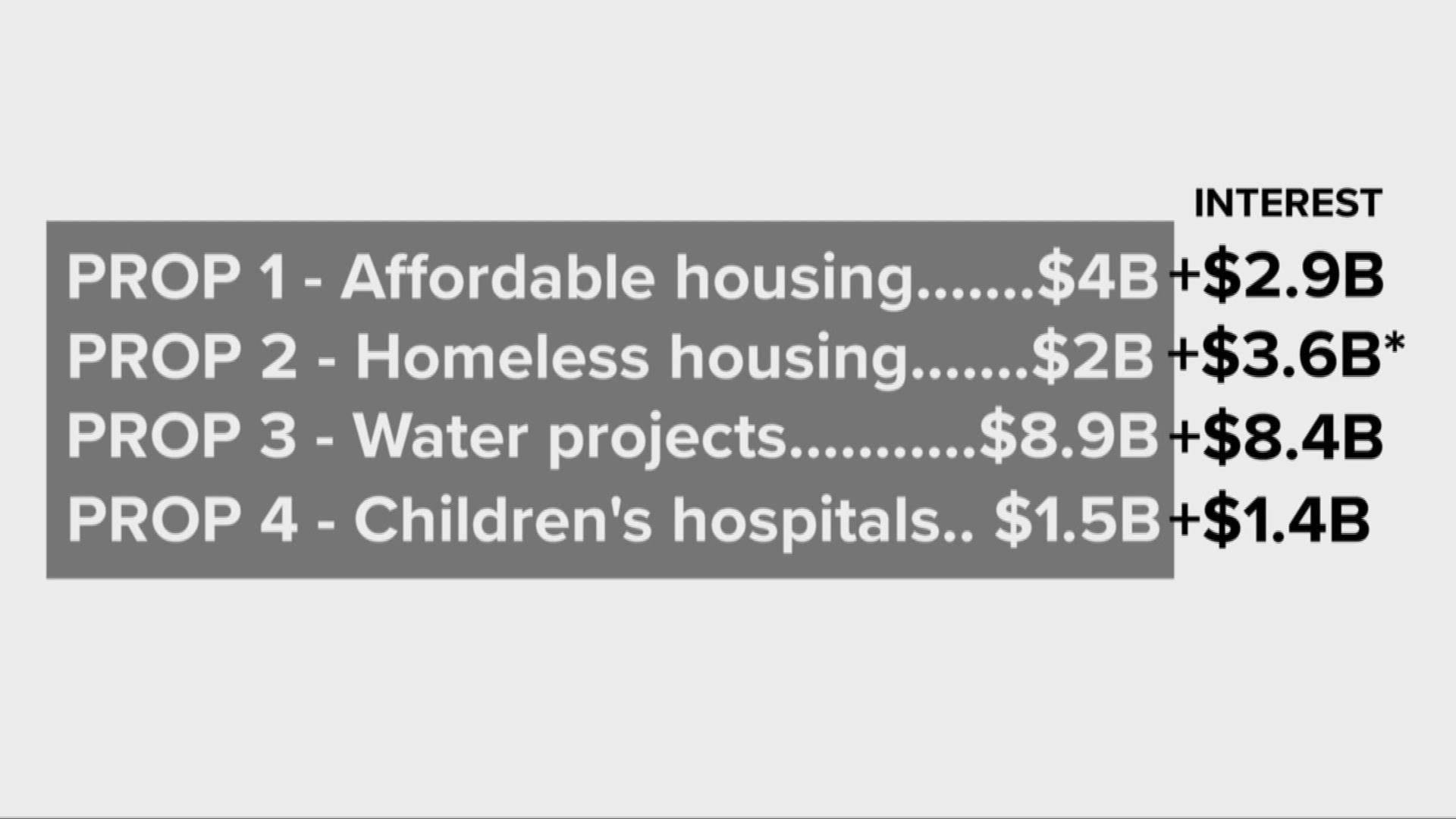

Props 1-4 would take out $16.4 billion of bonds to spend and then pay it back over the next four decades with another $16.3 billion of interest.

It costs $32 billion in the long run to be able to spend $16 billion today.

With the exception of prop 2 (see below) there is no dedicated source of funds to pay these back; they'd be repaid out of the state's general fund, aka your tax dollars at work. So what do these props want to buy?

PROP 1

This one takes out $4 billion to spend on affordable housing; $1 billion of it would be used to make home loans to veterans, who would then pay the money back, which means taxpayers wouldn't be on the hook to pay the interest on that portion.

Still, this bond would come with $2.9 billion of interest paid over 35 years, for a grand total cost to the state of $6.9 billion in the long run.

The remaining $3 billion is carved up this way:

- $1.8 billion to make loans to local governments, nonprofits, and developers to build affordable apartment units. These rentals need to be reserved for low-income people for at least 55 years.

- $450 million for housing projects and supporting infrastructure like roads and sewer lines in urban areas and locations near public transit.

- $450 in grant money to help low and moderate-income people buy homes, mainly in the form of down payment assistance.

- $300 million to be used as loans and grants to build housing for farm workers to buy or rent.

If you're still unsure, you can get even more detail about the proposed spending in the state voter guide or read the official arguments for and against Prop 1.

PROP 2

This is the only bond question that comes with its own plan to pay back its bond money. That's because it stems from the state's millionaire tax, passed by the voters in 2004's Prop 63.

The money was dedicated to mental health services. In 2006, state lawmakers voted to borrow $2 billion to be paid back from the millionaire tax money, which was going to county mental health services in the name of building housing for mentally ill homeless people.

That ended up in a court fight over whether the voters wanted this mental health money to be able to be used for housing mentally ill people.

This ballot question is an end-run around that court fight. Instead of asking a court to decide what the voters wanted, they're simply asking the voters for permission to move forward with the plan.

There's no set term for paying back the bond money. Opponents point out that the total payback cost for borrowing this $2 billion could be as high as $5.6 billion over 40 years, but it could be closer to $4 billion depending on the final terms of the bond.

PROP 3

At $8.9 billion, this is the most expensive of the bond measures on California's 2018 ballot.

It pays for water projects around the state and comes with a total price tag of $17.3 billion, paid back with your tax dollars over 40 years.

The money would be broken down into categories of spending, including environmental projects to help improve water flow and quality, increased water supply, fish and wildlife habitat, upgrades to water canals and dams, improving groundwater, and flood protection.

There's more detail on how the money is dedicated in the analysis and in the text of the proposition itself. You can also read arguments on both sides.

PROP 4

Rounding out the bond questions is this whether to spend $1.5 billion on construction for children's hospitals across the state.

Ninety percent of the funds are carved up among 13 different hospitals. Each private nonprofit children's hospital on the list (like the one at Stanford) gets $135 million and UC system children's hospitals (like the one at UC Davis) each get $54 million.

The remaining 10 percent ($150 million) is carved up among 150 or so other government and nonprofit children's hospitals around the state.

The money could be used "construction, expansion, remodeling, renovation, furnishing, equipping, financing, or refinancing" those hospitals.

Continue the conversation with Brandon on Facebook.