SACRAMENTO, Calif. — Gov. Gavin Newsom and his wife, First Partner Jennifer Siebel Newsom, took in $1.2 million from wages and investments in 2018, much of it generated from his wine and hospitality businesses, according to their most recent tax filings.

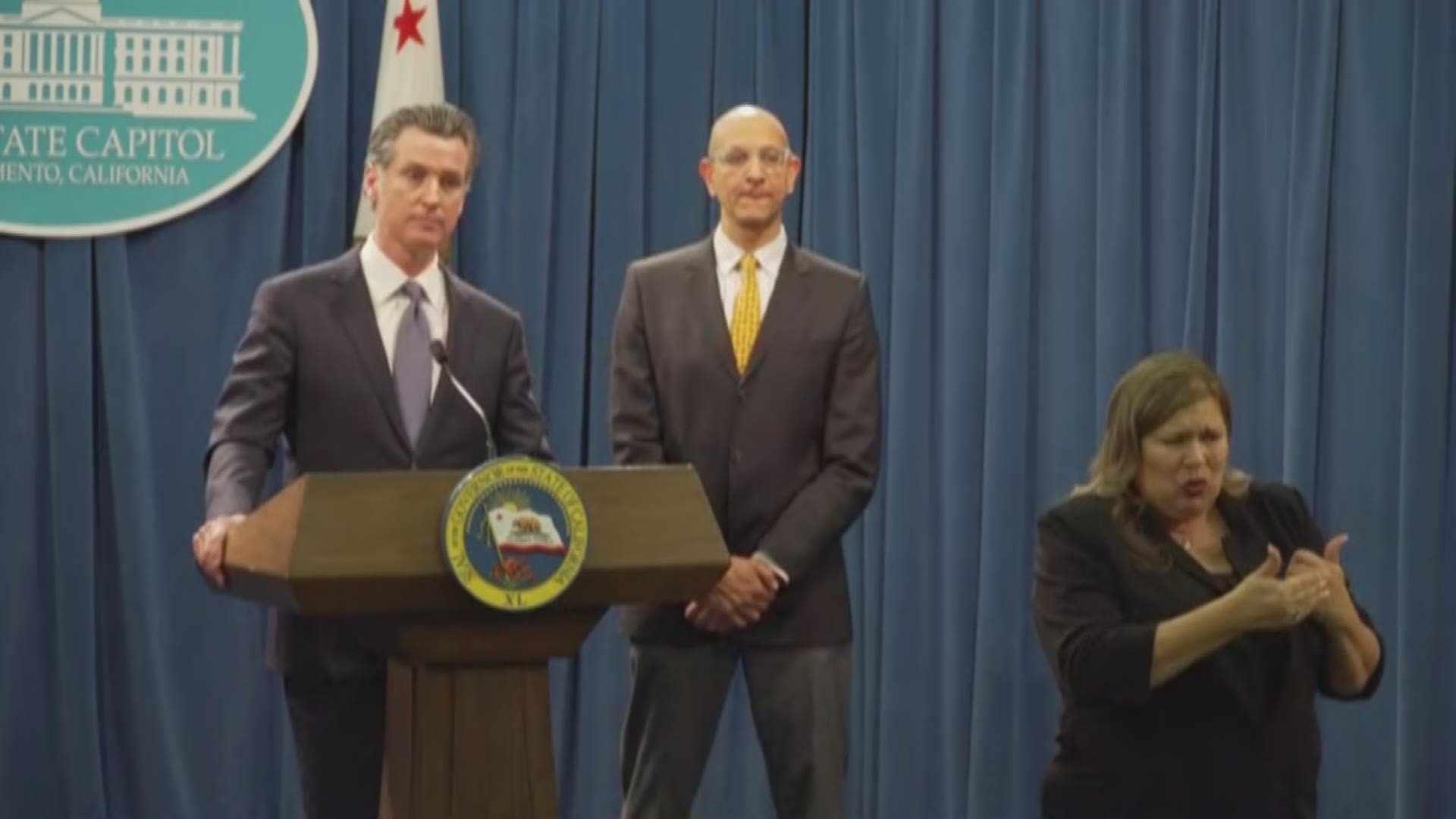

Newsom has pledged to release his tax returns every year while in office. He did the same during his gubernatorial campaign. On Friday, the governor’s office allowed reporters to review — but not take photographs of — a copy of the couple’s 2018 tax return at the Capitol.

The return confirms earlier reporting on the governor’s income: He is, as The Los Angeles Times reported during the 2018 campaign, “a career public servant and multimillionaire businessman.”

Like most 1-percenters, the Newsoms pulled in the bulk of their earnings that year from passive investments. They reported a combined salary of $393,806, including $151,260 from his elected position as lieutenant governor. But their thick tax filing revealed the couple earned $812,882 overall in 2018, largely from his business ventures in the wine industry.

Their filing mirrors how they have made money in the past, and actually reflects a dip in earnings compared to past years. Over time, Newsom has built up his stake in PlumpJack Group, which encompasses a chain of wine stores, wineries, restaurants, nightclubs, hotels and retail shops from Napa Valley to Palm Springs.

They reported income from various PlumpJack-related ventures but by far the most lucrative was $597,895 from Airelle Wines Inc., which runs the group’s Napa wineries.

Siebel Newsom, who runs a nonprofit organization and a production company called Girls Club Entertainment, reported $18,108 from a blind trust.

The Newsoms reported $75,751 in itemized deductions, including $25,683 in charitable gifts. Like many Californians, they were stung by recent federal tax changes that capped state and local tax deductions at $10,000. Had the law not been changed, they could have deducted nearly $59,000 on state and local taxes. However, the couple was able to deduct $36,250 in home mortgage interest.

They also paid salary and employment taxes for a nanny. But they made too much to claim $8,000 in child tax credits for their four children.

CalMatters.org is a nonprofit, nonpartisan media venture explaining California policies and politics.

READ MORE:

FOR NEWS IN YOUR COMMUNITY, DOWNLOAD THE ABC10 APP:

►Stay In the Know! Sign up now for ABC10's Daily Blend Newsletter