If you're viewing on the ABC10 App, tap here for multimedia.

Thousands of California residents who lost everything in deadly wildfires are about to experience another potential disaster: Recovery.

After the immediate needs of food, shelter and clothing have been met, the painful process of rebuilding lives will begin amid a tangle of bureaucracy, paperwork and financial disclaimers.

Victims of fires, floods, hurricanes, tornadoes and earthquakes face the same issues throughout the country.

How do you sort through the wreckage? You might have escaped with only a cellphone and the clothes on your back.

What is the first thing you Google? Getting birth certificates and drivers licenses? Filling prescriptions?

Maybe you need to file insurance claims and get back to work. Maybe you just want to get back and rebuild your home the way it once was.

Whatever the situation, no victim should be afraid to ask for help.

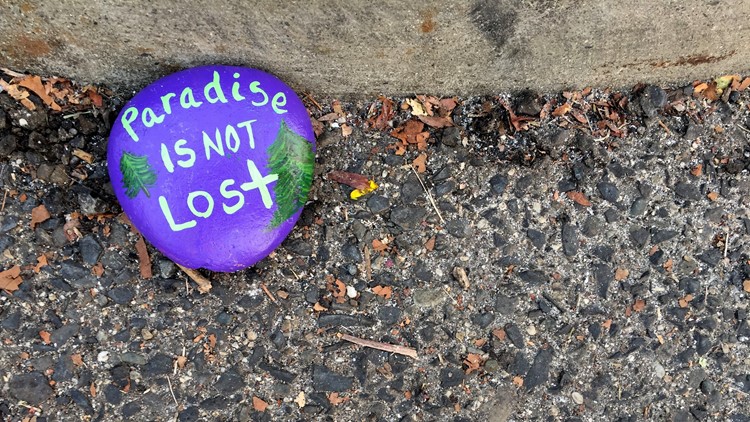

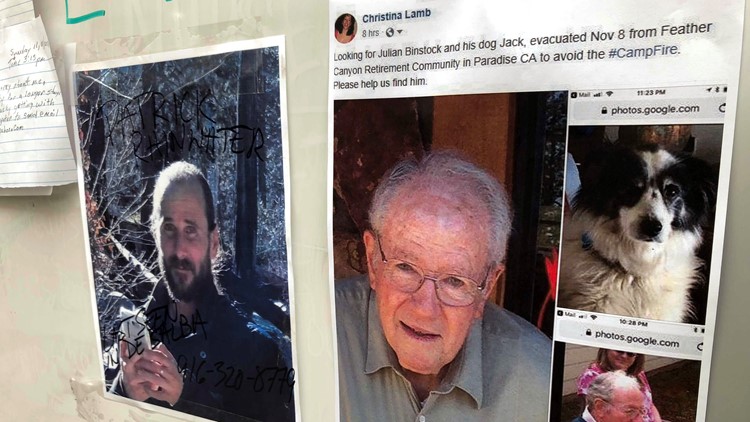

The sights of Butte County's Camp Fire

First steps on ladder to recovery

The scale of loss is overwhelming, and each person, each family, will have different needs.

Some first steps to consider as you begin rebuilding should include:

- Re-establishing your identity.

- Health needs.

- Getting a new car and paying off the old one.

- Going back to work or getting assistance.

- Reconstruction.

The Federal Emergency Management Agency has set up assistance centers for victims of wildfires in Butte and Ventura counties. The centers serve as one-stop shops for physical and mental health, insurance, housing, financial and social-services needs.

Start with getting identification

It might not be the first thing you think of, but a driver's license and Social Security card are key to re-establishing your life. You must have identification.

ID is critical for applying for benefits. You need it to drive and to access bank accounts, rent a car and pick up prescriptions. You might even need to show ID to get into your old neighborhood.

Driver's licenses, ID cards, vehicle registration and car title: The California Department of Motor Vehicles will replace documents for victims of wildfire free of charge in the following counties: Ventura, Los Angeles, Butte, Lake, San Diego, Santa Barbara and Siskiyou, Riverside, Shasta, Mendocino, Napa, and Mariposa.

Social Security cards: Can be replaced at your local Social Security office. You will need to fill out a form that can be mailed. The agency typically requires two forms of ID. In the case of disasters, they will accept alternatives to driver's licenses.

Birth and marriage certificates: Can be obtained in every state through departments of vital statistics. The Centers for Disease Control and Prevention maintains a database of locations broken down by state. In California, the Department of Public Health maintains those records.

Pharmacies keep records of your prescriptions

Quick access to medicine might top all your needs. Diabetes, asthma, blood pressure and heart issues are among chronic conditions that can kill you if left untreated.

Contact your doctor. The first thing you can do is call your doctor to request refills or even samples depending on how critical it is to get the drug.

Call your pharmacy. If your doctor's office is unavailable, your pharmacy likely has a record of your prescriptions and can help you order new ones. Even if your local pharmacy is closed, most national chains keep electronic records and can help you get refills.

Sometimes insurance companies will balk at replacing expensive drugs or claim benefits don't cover refills. The designation of state and federal emergencies often will eliminate those hurdles.

If you believe your insurance company is acting unreasonably or in violation of the law, you can contact state regulators. Insurance companies are licensed and regulated by state departments of insurance. California consumers can file complaints here.

Will insurance pay off my auto loan?

If your car was destroyed in a fire, how much you get for it depends on your auto policy.

The sad reality for some is that insurance won't pay off their loans and they will have to keep making payments on totaled cars.

Cars are often under-insured. The axiom about your car being worth less than what you owe once you drive it off the lot is true for many. That's particularly true for new cars bought with little or no money down.

Most homeowners policies do not cover automobiles. Standard car insurance policies cover only the value of the car, not the amount of loan. There are separate policies that cover this "gap."

The difference between the insurance payoff and the loan amount is called the deficiency, and it can be significant.

Debt on an old car loan could prevent you from getting a new one. To protect yourself, check with the dealer where you bought the car to see if gap insurance was included in the financing arrangement.

Consider negotiating a settlement with the finance company. Some might be willing to reduce the amount owed for a one-time payment.

Financial help, loans, relief

Money is available for victims of disasters from local, state and federal agencies.

The mission of many non-profits includes responding to disasters. Some are well known, such as the American Red Cross, The Salvation Army and St. Vincent de Paul. Others are less known but no less ready to help.

The Buddhist Tzu Chi Foundation is providing emergency cash to victims of the Camp Fire in Butte County. The United Way of Northern California also is offering financial relief to fire victims.

Trade unions have established resources for fire victims. The California Labor Federation has created a list of resources for various union members, including teachers, performers in the arts and entertainment industry, firefighters, nurses and many others.

The federal government has a range of disaster relief, from business loans, tax relief, insurance, mortgage assistance. Many of those programs are detailed at www.benefits. gov, which offers portals to different programs.

Banks are offering financial assistance to customers. The consumer assistance site bankrate.com says financial institutions consider customers’ situations case by case and many have disaster relief programs. It has compiled a list of several banks and their disaster-relief programs.

My work is gone. Where do I go?

Going back to work may be impossible. For some people, places of employment might have been destroyed along with their homes.

There are resources for unemployment assistance and job-training programs. In California, the waiting period for benefits has been waived for victims. The California Employment Development Department will assist with applications and job searches.

Federal Disaster Unemployment Assistance is also available for victims of the Camp Fire in Butte County, the Hill Fire in Ventura County, and the Woolsey Fire in Los Angeles and Ventura counties.

The National Employment Law Project explains that assistance is available to workers who do not qualify for regular state unemployment insurance. The deadline for filing applications is Dec. 14.

Benefits are open to the self-employed. Tax returns, business licenses, property leases and corporation documents all can be used as proof to qualify.

Insurance: Be wary of the good-hands people

Some homeowners trying to recover from a disaster may struggle with their insurance providers. But the biggest issue might be underinsurance.

More than 5,300 homes were destroyed in a wildfire that tore through Santa Rosa, Calif. in 2017. A year after what was then the worst wildfire in state history, only 50 homes had been rebuilt, according to the Press Democrat newspaper.

Often, policies aren't enough to cover the cost of repairs.

Most homeowner's policies will cover loss of residence and contents. Say you own a $500,000 house and have insurance for up to $700,000 on the structure and $300,000 on the contents. On paper, $1 million appears as if it should be enough to rebuild.

But Santa Rosa homeowners discovered today's construction costs are significantly more than their policies provided. That has left them dipping into savings, retirement accounts and using money earmarked for household goods to pay for construction, according to a CBS News report.

Losses from the Camp and Woolsey wildfires in California are estimated between $9 and $13 billion, according to the Insurance Journal.

Consumer experts and residents who have fought their own battles with insurance companies advise caution when dealing with adjusters. These are just some of their recommendations:

- Don't accept the first offer. Wait until you can assess actual losses and the cost to rebuild.

- Be ready to appeal decisions.

- Check out your adjuster. Make sure he/ she is licensed to practice in the state and knows the market.

- Make sure you get all of your benefits. For instance, in California, the law allows homeowners up to 24 months of living expenses based on policy limits.

- Choose the contractor of your choice; you are not limited to the one an insurance company recommends.

Robert Anglen covers consumer issues and investigations. Reach him at robert.anglen@arizonarepublic.com or on Twitter @robertanglen.

Watch episode 8 "The New Normal" now: California’s leaders tell us we’ve entered a “new normal” of more intense wildfires. The truth is: Experts think the deadly mega-fires we’ve seen are just a preview of the new normal.