No, California doesn’t take more taxes out of your paycheck than any other state.

It doesn’t even tax the highest compared to other states in the West, but that doesn’t mean we’re not a heavily taxed state – especially if you’re earning a high income – and that doesn’t mean it’s cheap to live in California.

With earning a paycheck comes the inevitable blow of losing a portion to state and federal taxes.

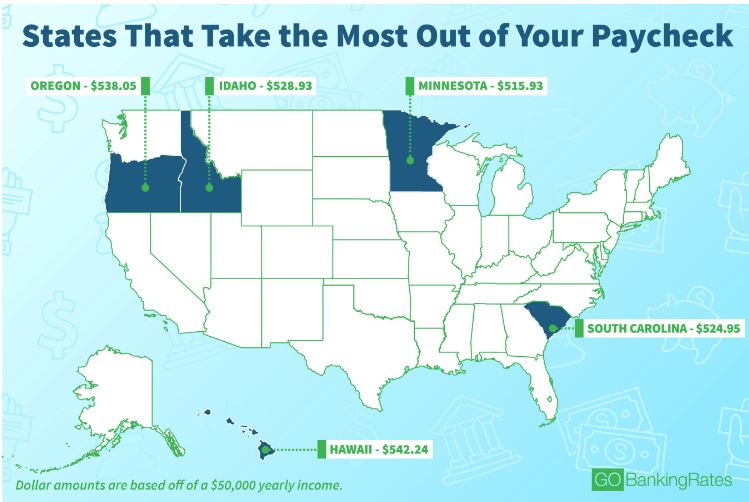

According to an analysis from GoBankingRates, a personal finance news site, the worst state for middle-come earners ($50,000 salary) is Hawaii where an average of $542.24 is taken from a biweekly $1,923.08 paycheck. Oregon, Idaho, South Carolina and Minnesota round out the top five.

For comparison, California takes out an average $495.43 from middle-income earners on a biweekly basis.

However, California is the second-highest taxed state for people earning $100,000 or more. For every biweekly paycheck of about $3,846.15, the Golden State on average takes $1,335.66 – more than a third. Oregon takes the top spot with $1,340.95.

The states that take the least out of your check, about $402.93 for people earning a $50,000 salary, do not have a state income tax: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming.

In California, heavily taxing higher income earners has a majority of the public’s support.

Californians voted in 2016 to extend by 12 years the personal income tax increase on people earning more than $250,000, which was approved in 2012’s Prop. 30 and was originally set to expire in 2018.

The other part of Prop. 30 dealing with sales taxes, however, was not extended.

At 7.25 percent, California boasts the highest state-level sales tax rate in 2017. But that’s actually a slight decrease after the expiration of Prop. 30’s sales tax increase, which lifted it to 7.5 percent.

Cities and counties can also implement a sales tax to cover roadwork and other local projects. In Sacramento, the total sales tax is 8.25 percent -- compared to 7.38 percent in Modesto.

Since its implementation, Prop. 30 has brought in $7 to $8 billion in annual tax revenue. With the sales tax portion expired, the Legislative Analysts’ Office estimates that revenue to drop to around $3 billion for the 2018-19 fiscal year.

Even though California isn't the highest taxed, that doesn't mean most people aren't living paycheck to paycheck.

Housing, transportation and the cost of living make the California lifestyle very expensive, according to GoBankingRates. After all of these are accounted for, the average person only has about 6.51 percent of their income left over. The only state you'd be more likely living paycheck to paycheck in is Hawaii.