If you are viewing on the ABC10 app, tap here for multimedia.

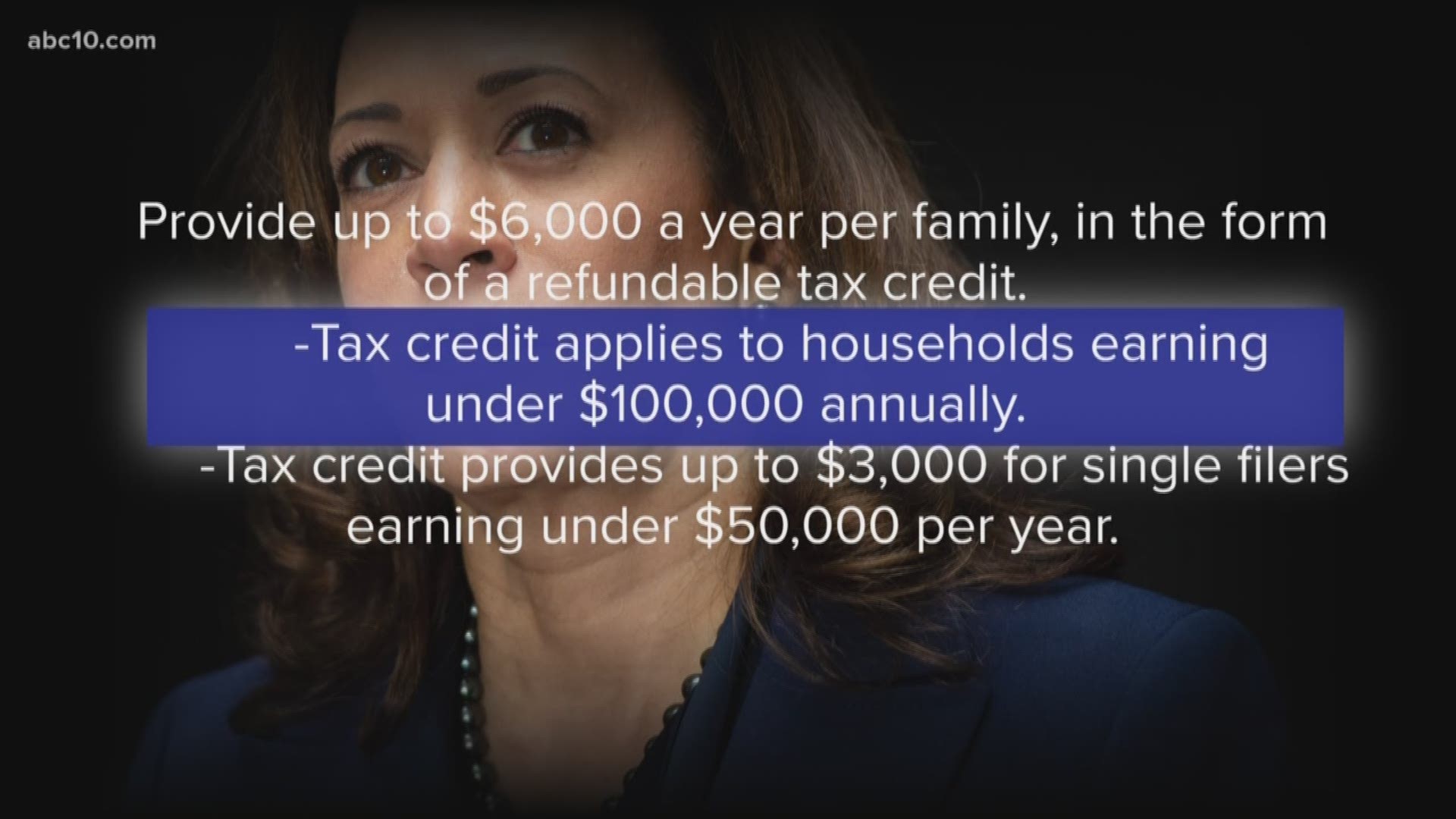

California Senator Kamala Harris proposed a sweeping tax plan Thursday that would provide up to $6,000 per year for middle and working-class families.

The Livable Income for Families Today (LIFT) Act would apply to families making less than $100,000 a year or individuals making less than $50,000 per year, according to Harris’ office.

“Americans are working harder than ever but stagnant wages mean they can’t keep up with cost of living increases,” Harris said.

Families eligible for the tax credit could access the money at approximately $500 per month or get it all at the end of the year for $6,000, according to the plan. Individuals would be given the same option, at an extra $250 per month or $3,000 at the end of the year.

According to the senator's office, the Institute on Taxation and Economic Policy (ITEP) estimates the LIFT Act would impact one in every two workers and two out of every three children in the country.

In addition, ITEP estimates about a million Pell Grant-eligible students would qualify for the credit of up to $3,000.

“We should put money back into the pockets of American families to address rising costs of childcare, housing, tuition, and other expenses,” Harris said. “Our tax code should reflect our values and instead of more tax breaks for the top one percent and corporations, we should be lifting up millions of American families.”