SACRAMENTO, Calif. — The lingo and jargon on election ballots can be confusing, so it's important to understand what you're reading and what a "yes" or "no" vote could mean.

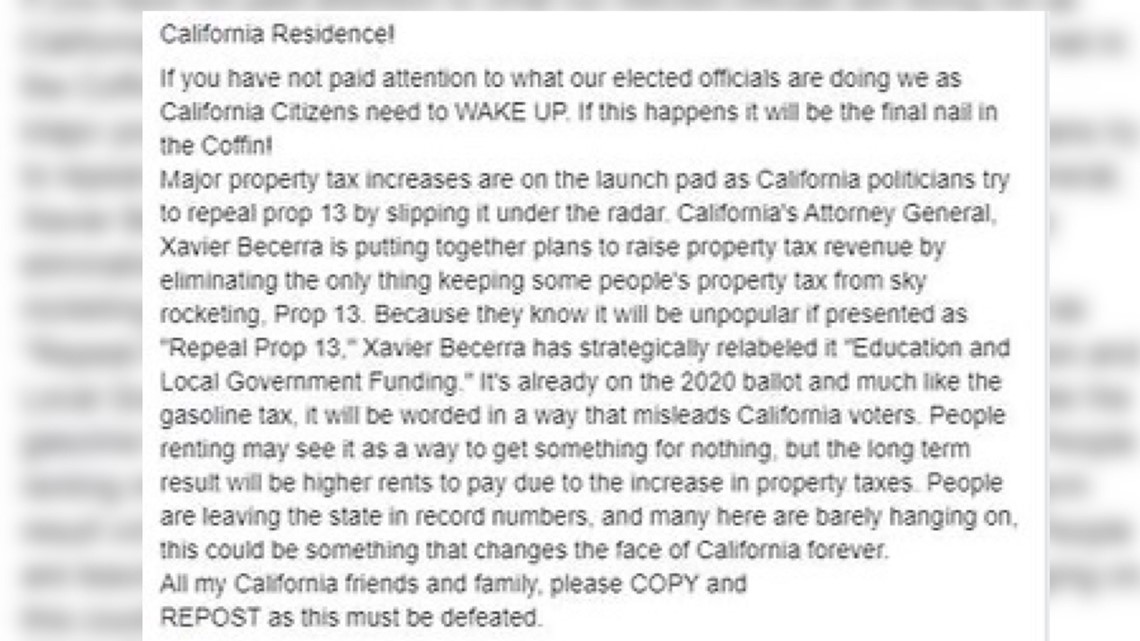

On Monday, a Facebook user shared a post that said California politicians are trying to repeal Proposition 13 by "slipping it under the radar" on the 2020 ballot. Prop 13 is the 1978 constitutional amendment that limits increases on residential and commercial property taxes.

The Facebook user said Attorney General Xavier Becerra "has strategically relabeled it [Prop 13] 'Education and Local Government Funding.'"

THE QUESTION: Is there something on the ballot that will repeal Proposition 13?

WHAT WE FOUND: The California Secretary of State website said there is an initiative called "The California Schools and Local Communities Funding Act of 2020." It has received at least 25% of required signatures to qualify for the Nov. 2020 ballot. This initiative would undo the property tax caps of Prop 13, but only for commercial and industrial properties. This initiative would not take away the Prop 13 protections for residential properties, California Secretary of State Spokesperson Sam Mahood said.

"The California Schools and Local Communities Funding Act would require that certain commercial properties are taxed at fair market value," Mahood said.

THE ANSWER: No, there is no ballot question right now that would repeal Prop 13 in its entirety. There's not an initiative that would undo Prop 13's property tax protection for people's homes. There is, however, a ballot question in the works that would change how property taxes work for commercial and industrial-zoned property. This measure would allow those types of properties to be taxed at the full market rate. Read the proposal here.

(Editor's note: This article has been updated to reflect the ballot initiative's correct full title and status as having received at least 25% of the signatures required to be added to the Nov. 2020 ballot. Also, this article's headline has been updated to refer to residential property taxes increase as the focus of the article.)

READ ALSO:

FOR NEWS IN YOUR COMMUNITY, DOWNLOAD THE ABC10 APP:

►Stay In the Know! Sign up now for ABC10's Daily Blend Newsletter

Can you legally just not stop and show your receipt at a Walmart checkpoint? We VERIFY. Read more here: https://on.abc10.com/2CS2VFb