SACRAMENTO, Calif — So much for California saving itself from the economic wreckage of the coronavirus.

As state lawmakers ended the year with a profanity-laced, partially remote late-night voting session this week, several pillars of a sweeping $100 billion economic stimulus proposal became political casualties of a chaotic summer at the Capitol.

Restarting supplemental $600-a-week unemployment payments? Not happening. Investing in wildfire prevention and broadband infrastructure to create jobs? Nope. Offering tax vouchers to raise revenue and stave off future cuts? Maybe, if state agencies find their own path forward.

“I think we made lives better,” Senate leader Toni Atkins said during a 2 a.m. Zoom press conference after the final votes Monday night. “Were we able to get everything done we’d hoped to? No, we weren’t.”

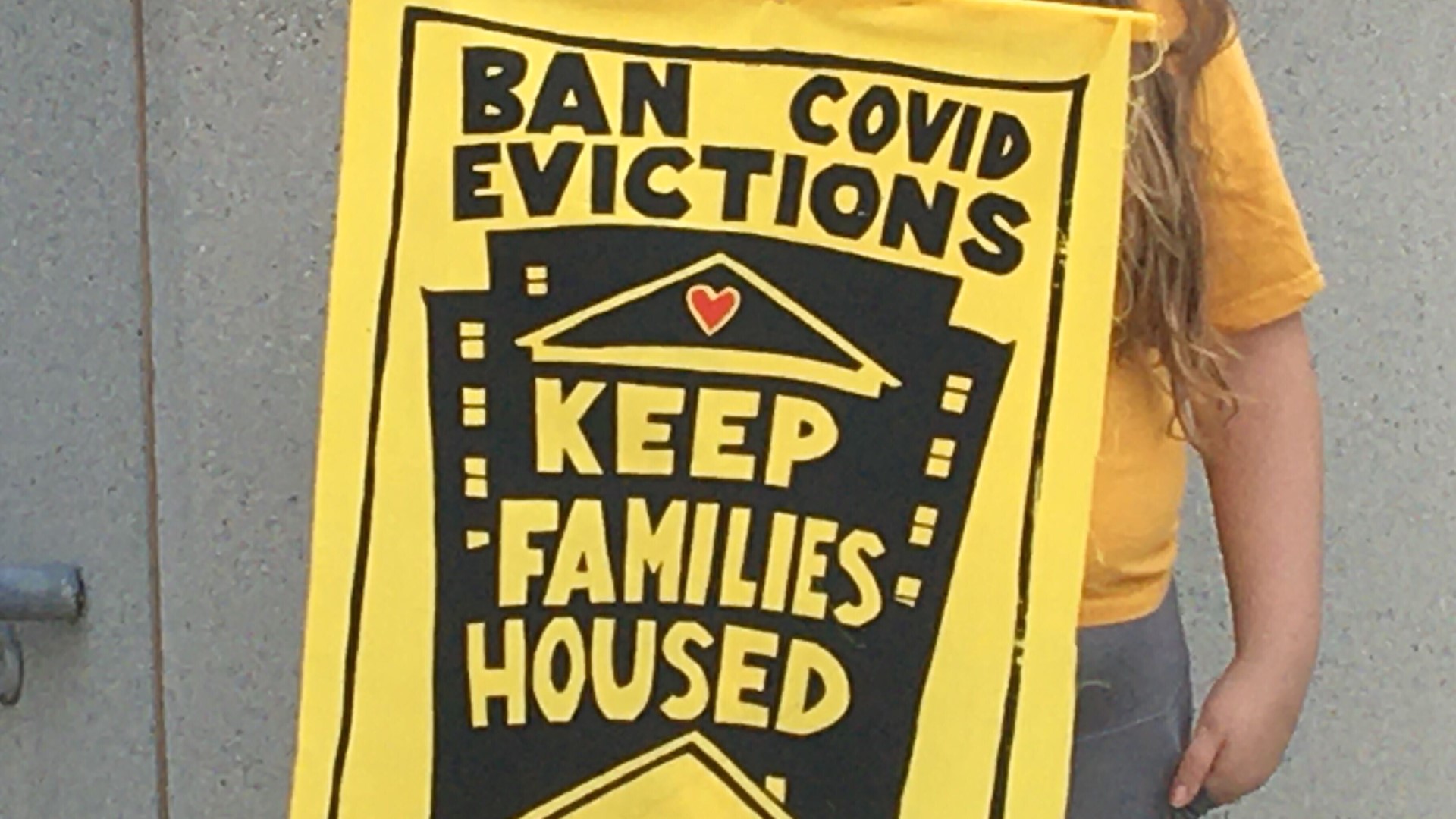

Among the economic measures that survived were a $5 billion transportation bond, an eviction moratorium extension, an expansion of low-income tax credits for undocumented Californians, and a $100 million small business hiring credit. There are many reasons that the most high-profile proposals fell through, or were at least left unresolved: federal inaction, Democratic infighting, the risk of digging too deep a financial hole to climb out of, plus the complicated logistics of last-minute negotiations during a pandemic.

Now, as politicians turn their attention to election season, bigger battles loom. During a pandemic that has both deepened inequality and made the state’s wealthiest residents richer, the question is how much California will try to do on its own — and whether liberal enclaves, such as San Francisco, are in the mood to soak the rich. The state is currently relying on borrowing from the federal government, but there’s also the option to take on structural changes to the tax code or make more technocratic changes to how the state handles cash.

“The idea of states running stimulus is not conventional economic wisdom,” said Tracy Gordon, a senior fellow at the Urban-Brookings Tax Policy Center. “I wouldn’t take the heat off of Congress. This is really their responsibility.”

Still, for state lawmakers under pressure to act, especially given California’s often-touted distinction as the world’s fifth-largest economy, the stimulus debate is likely just beginning. Gov. Gavin Newsom hasn’t yet signaled his preferred economic path forward, but the familiar barrage of doomsday analysis — “California Is Coming for You,” “California is a failed state” — has already arrived.

“This is the problem from hell,” said Jack Pitney, a political science professor at Claremont McKenna College. “On the one hand, the COVID crisis vastly increases the need for economic stimulus. At the same time, it decreases the state’s ability to deliver it.”

An unemployment impasse

So, how bad is the economic outlook for California? By some recent indicators, it’s not as dire as feared — at least for now.

The state was facing a $54 billion deficit heading into budget season, but “the situation did not significantly deteriorate,” according to a new report from the Legislative Analyst’s Office. As of July 31, the state had a $37 billion cash cushion to keep paying its bills or more than triple the predicted worst-case scenario. Tax receipts also came in nearly $2.6 billion higher than expected.

The state “fiscally is in a much better position than it was” at the beginning of the pandemic, thanks in large part to cash reserves and a stock rally that has buoyed California’s tech industry, said Mark Duggan, an economics professor at Stanford University and director of the Stanford Institute for Economic Policy Research. Still, he said, the state is likely “in for a lot of pain” with unemployment over 13%. The state has already borrowed more than $10 billion from the federal government to pay for jobless benefits.

“California is hemorrhaging money right now,” Duggan said. “Thank God that it’s possible for states to borrow from the federal government because without that, we would be screwed.”

For the millions of state residents relying on unemployment checks, an August order by President Trump extended a temporary $300-per-week benefits bump. Congressional Republicans, wary that higher $600-a-week payments discouraged people from going back to work during the pandemic, have blocked longer-term efforts to extend supplemental payments. Californians left with less cash to buy basic necessities are liquidating retirement funds, scrambling to pay rent, and turning to food assistance programs, which is why state lawmakers hoped to intervene.

“Ultimately we ran out of time because the federal government didn’t act,” said Assemblymember Phil Ting, a Bay Area Democrat who pushed for stimulus measures to include more unemployment assistance. “We didn’t want to jump the gun and really take the federal government off the hook.”

Though California is well known for its high state income taxes, economists point out that payroll taxes for unemployment insurance are surprisingly low. As it stands, the state has one of the nation’s most regressive unemployment programs, Duggan wrote in a recent report, where employers are taxed the same amount for an employee earning $7,000 as one making many times more.

“It just makes absolutely no sense,” he said. “For a big tech company that’s paying six-figure salaries, it’s like a rounding error.”

‘Pretty desperate’

While unemployment is tied up in federal politics, another stimulus idea — asking businesses to prepay some taxes now in exchange for tax vouchers to use later — would put the state in control of raising more revenue.

Lawmakers didn’t come up with their own voucher plan before they adjourned but instead asked the state Department of Finance and Franchise Tax Board to come up with a plan to raise up to $25 billion. Vouchers would be paid out over several years to avoid a big financial hit down the road, but some economists are skeptical of how many taxpayers would volunteer to pay early.

“It seems pretty desperate,” Duggan said.

In the meantime, voters will also weigh in on the future of the state’s economy. Prop. 15 asks voters to approve a tax hike on commercial property owners to fund schools and local government. Prop. 22 will decide (again) if tech companies like Uber and Lyft should pay into state employee benefits systems including unemployment.

WATCH MORE: California bills passed at the last minute